|

|

2011 Tax Tables Updated

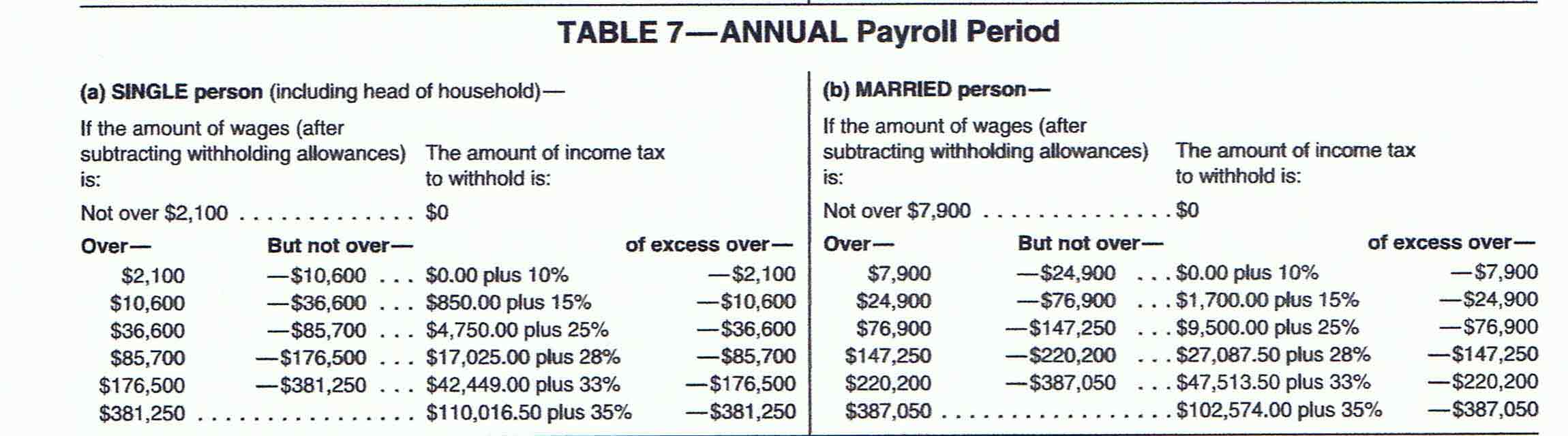

The following tables are the new Federal tax tables for the year 2011 and must be manually entered into the tax tables through Tax Table Maintenance. They were taken from Notice 1036, December 2010.

The Personal Withholding table is the Annual Payroll Period Table 7. To view the publication click here--> Notice 1036 The publication is in pdf format and requires Adobe Acrobat reader to view. Click on the icon below to download a free copy of Acrobat reader.

|

The following tables are excerpts from the publication.

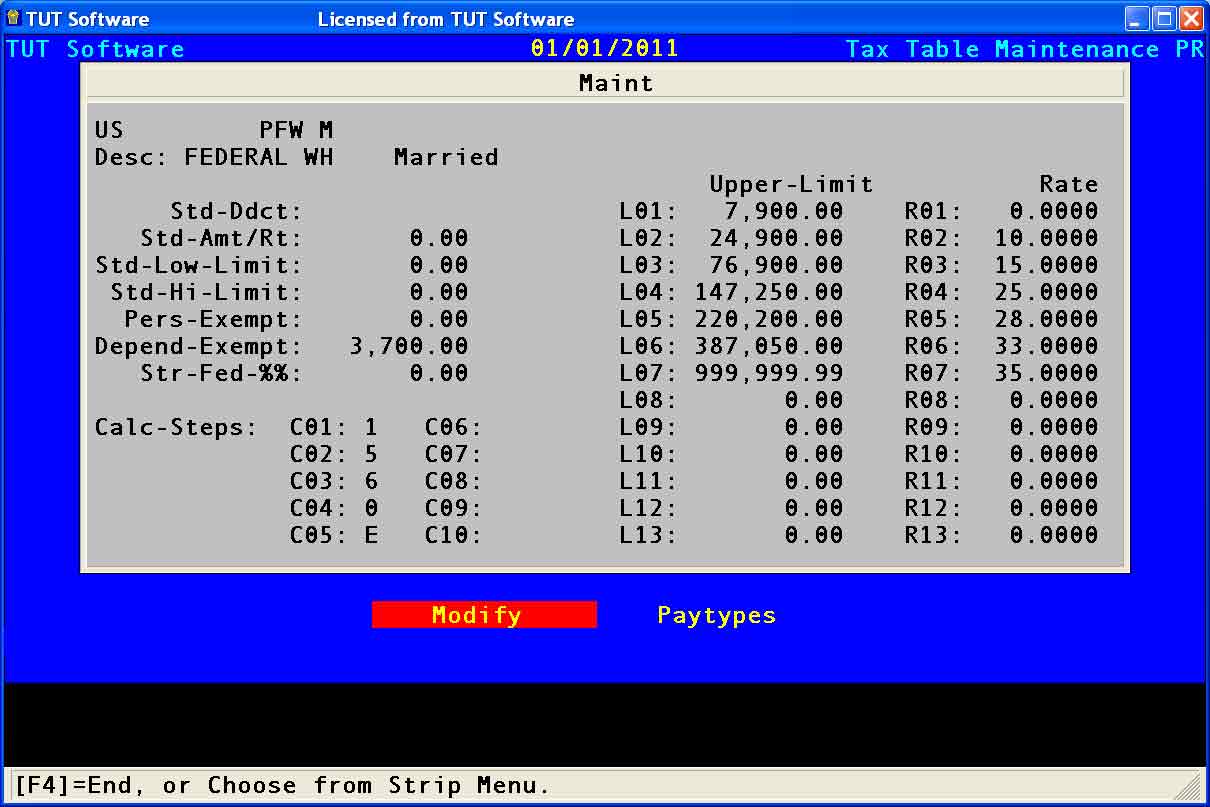

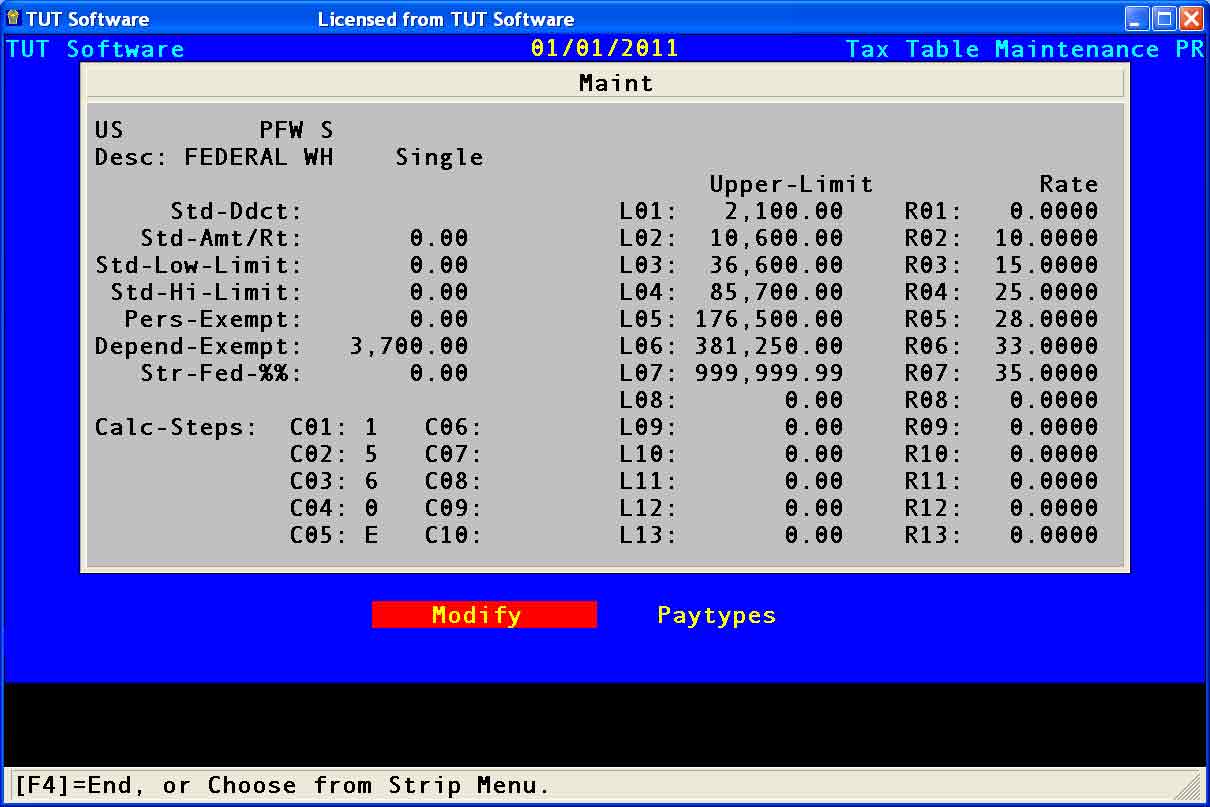

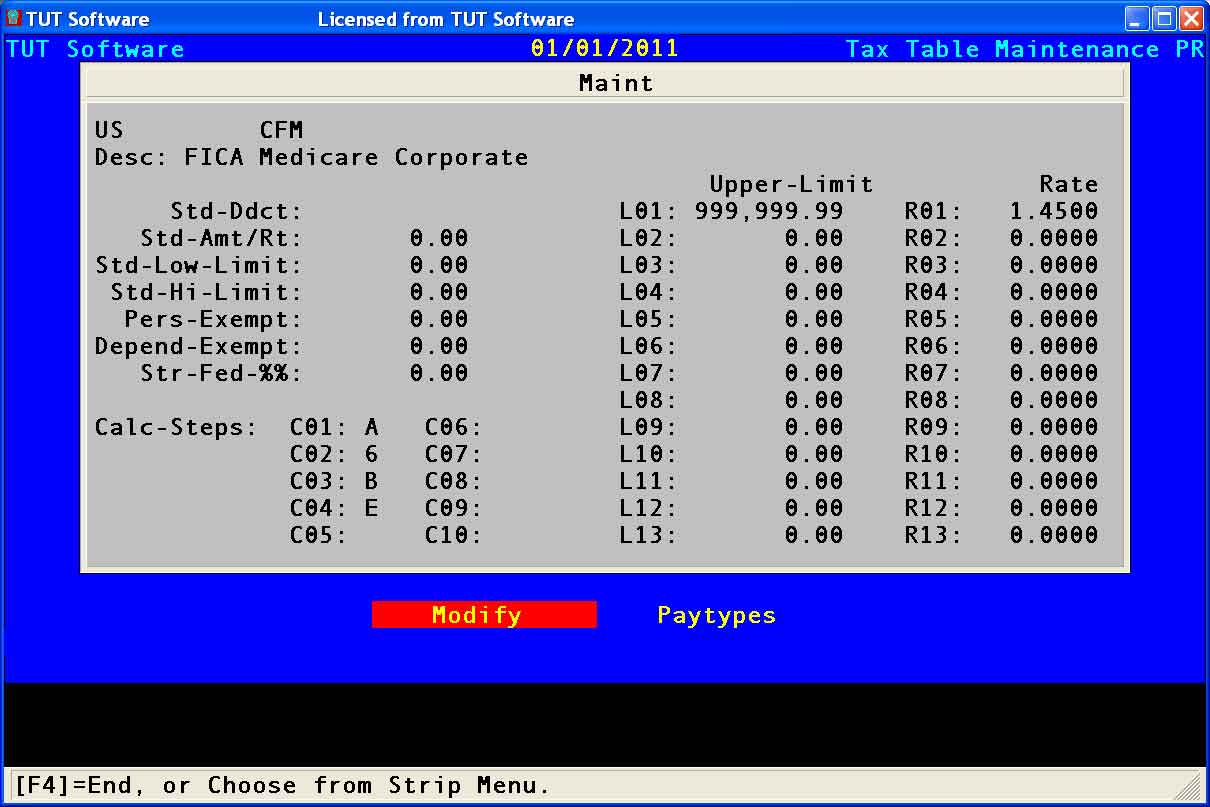

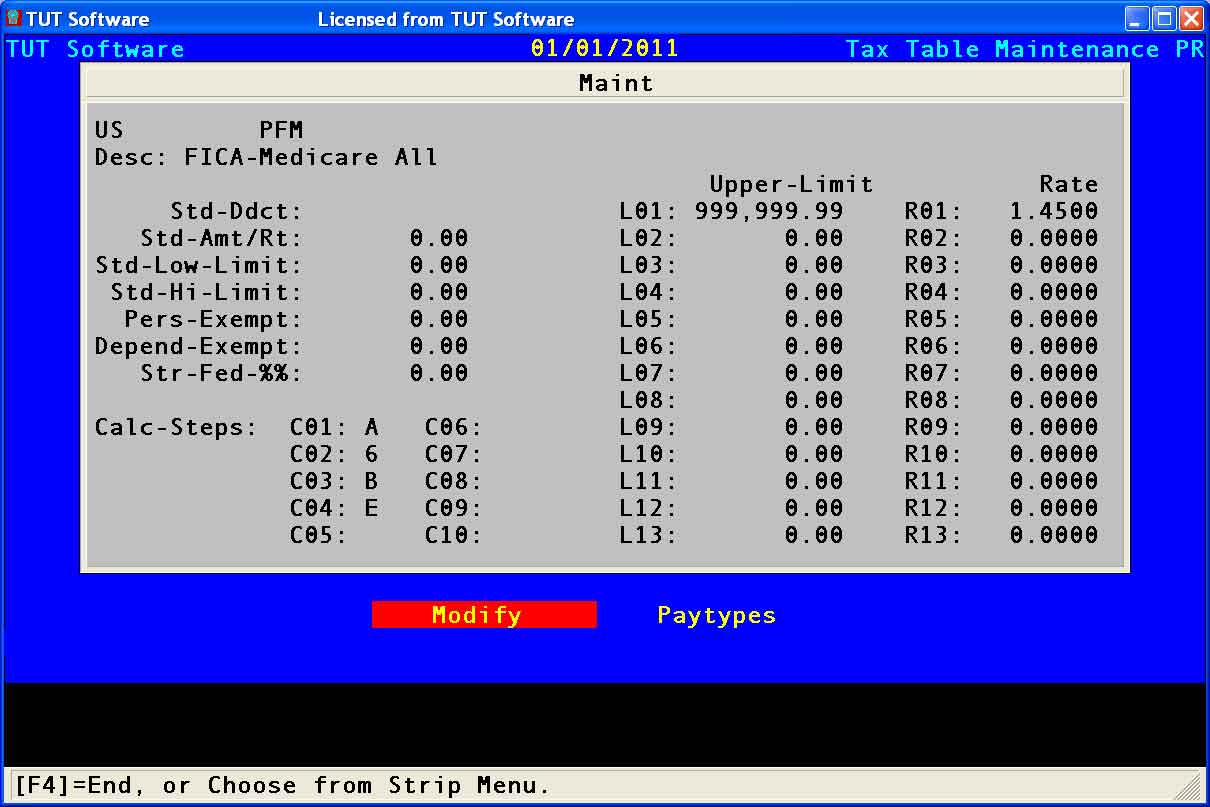

Your Tax tables should look like the screen captures from my TUT System.

*Make sure you reset any New Hire Tax Keys Back after the first of the year!!!

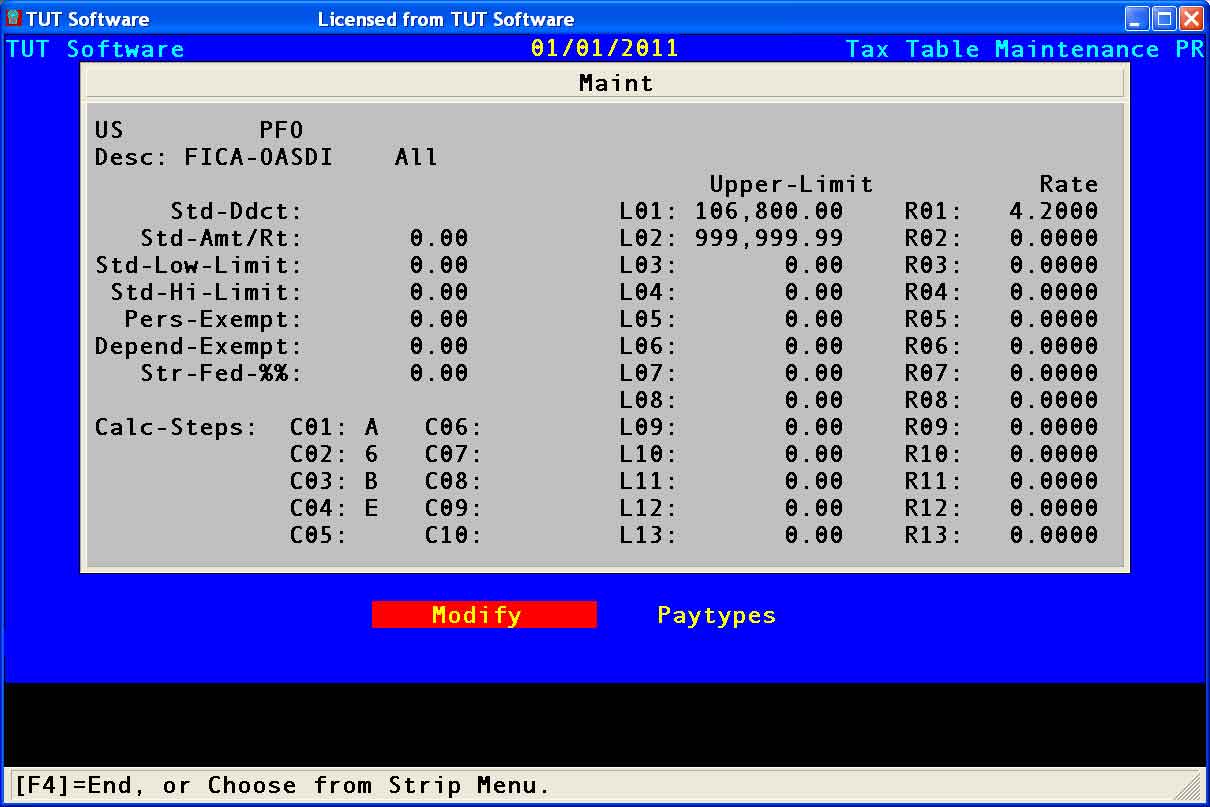

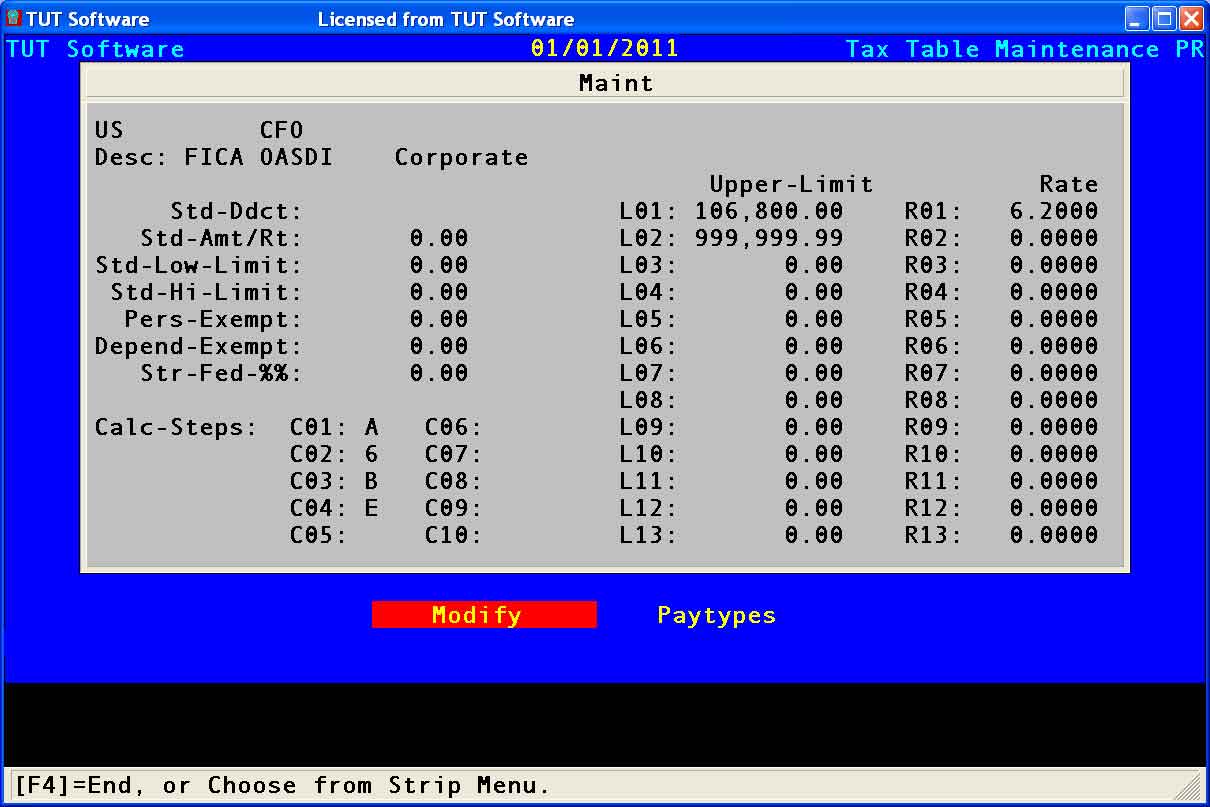

Social security and Medicare tax for 2011.

For 2011,the employee tax rate for social security is 4.2%.

The employer tax rate for social security remains

unchanged at 6.2%. The 2011 social security wage base

limit is $106,800. In 2011, the Medicare tax rate is 1.45%

each for employers and employees, unchanged from

2010. There is no wage base limit for Medicare tax.

Employers should implement the 4.2% employee

social security tax rate as soon as possible, but not later

than January 31, 2011. After implementing the new 4.2%

rate, employers should make an offsetting adjustment in

a subsequent pay period to correct any overwithholding

of social security tax as soon as possible, but not later W

than March 31, 2011.

One Withholding

Payroll Period Allowance

Weekly $ 71.15

Biweekly 142.31

Semimonthly 154.17

Monthly 308.33

Quarterly 925.00

Semiannually 1,850.00

Annually 3,700.00

Daily or Miscellaneous 14.23

Pay close attention because there are two less tax brackets this year. So after you set L07 to 999,999.99,

zero out L08 and L09. Do the same for the rates too.